Generative AI in Finance Functions – A Perspective

Generative AI in Finance Functions – A Perspective

- November 21, 2023

- 5 Min Read

- Arun Krishnan

With the massive surge in interest in Generative AI (GenAI), every organizational department is looking at its processes to identify those who can benefit from this new and seemingly miraculous technology. Given the nature of the technology – it is a language model – most initial use cases have centered around organizational functions like administrative, legal, HR and marketing.

A recent article by the Boston Consulting Group (BCG) sheds light on what CFOs need to do to take advantage of the GenAI bus.

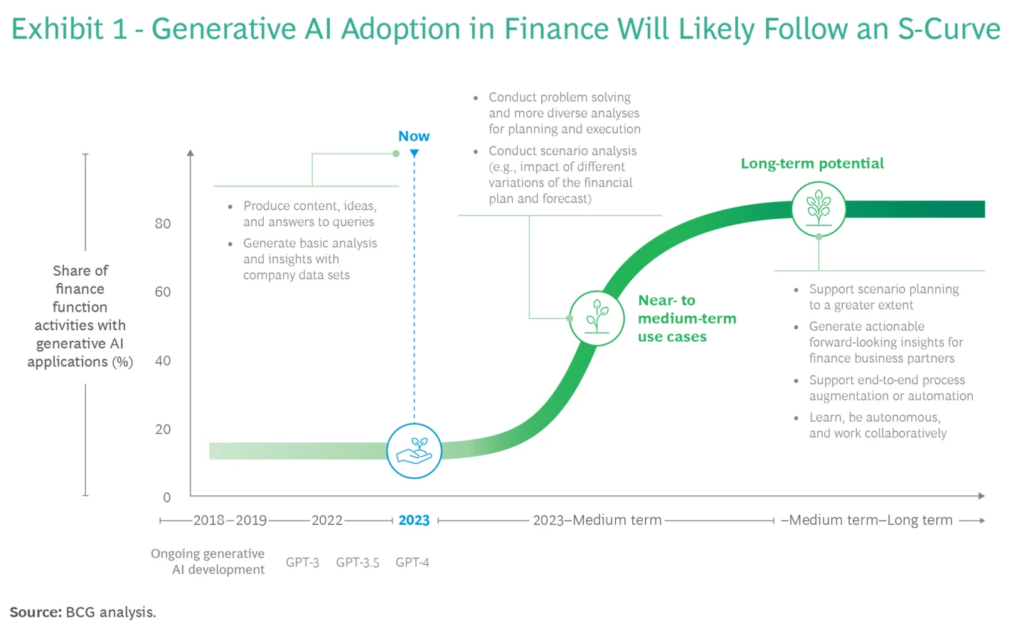

The current share of finance function activities with GenAI applications is relatively small but, the authors predict, is expected to show a typical S-shaped growth curve in the coming years. Since GenAI, at the moment, is excellent at creating content and summarisation, the applications revolve around these strengths of the technology, such as producing content ideas and generating basis analysis and insights with financial datasets.

However, as the technology evolves, the applications are expected to start moving towards more diverse analysis for planning and execution, help with scenario analysis, and eventually graduate to generating actionable, forward-looking insights for finance business partners and support end-to-end process augmentation.

How must CFOs go about transforming their functions?

CFOs need to follow a four-fold approach towards introducing GenAI into their functions. They are:

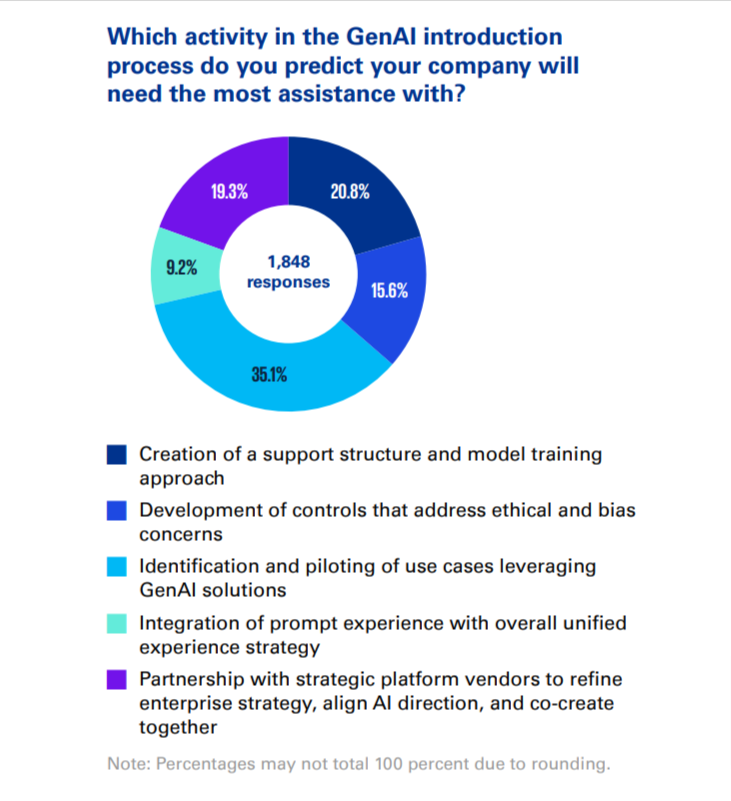

- Ideate: Create a GenAI strategy for your organization that aligns with the overall business strategy.

- Incubate: Identify and test the early, viable use cases. Get your PoCs going quickly. Fail fast.

- Implement: Implement controls and solutions that address ethical issues and bias concerns.

- Integrate: Work with strategic vendor partners to refine, align, and co-create strategy and innovation in this area.

What are the challenges that CFOs are likely to face?

The challenges are not necessarily unique to CFOs but to all leaders working on implementing GenAI in their respective functions/organizations.

- Data Accuracy: GenAI tools, being language models, struggle to perform accurate calculations. Organizations must be aware of this weakness of LLM models and provide workarounds.

- Data Privacy: Training GenAI models on public clouds could compromise proprietary data, leading to security breaches and leaks.

- Data Governance: GenAI tools lack contextual awareness and real-time information. They need more implicit or explicit governance models for validating outputs.

- Data Hallucinations: GenAI models are susceptible to hallucinations, leading to erroneous information being returned as outputs.

What are other finance functions saying about their adoption of GenAI?

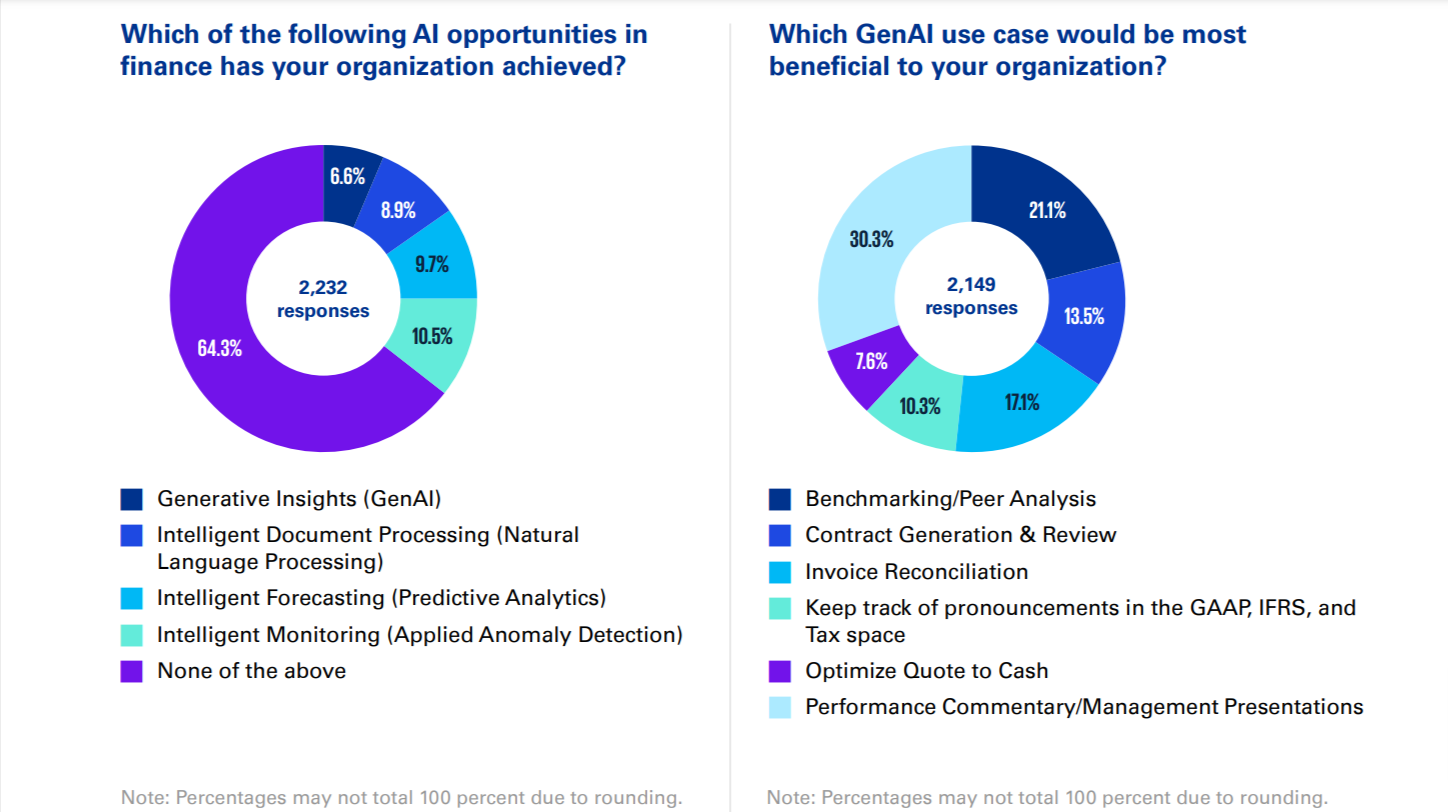

Source: KMPG Report – GenAI for Finance Leaders

Source: KMPG Report – GenAI for Finance Leaders

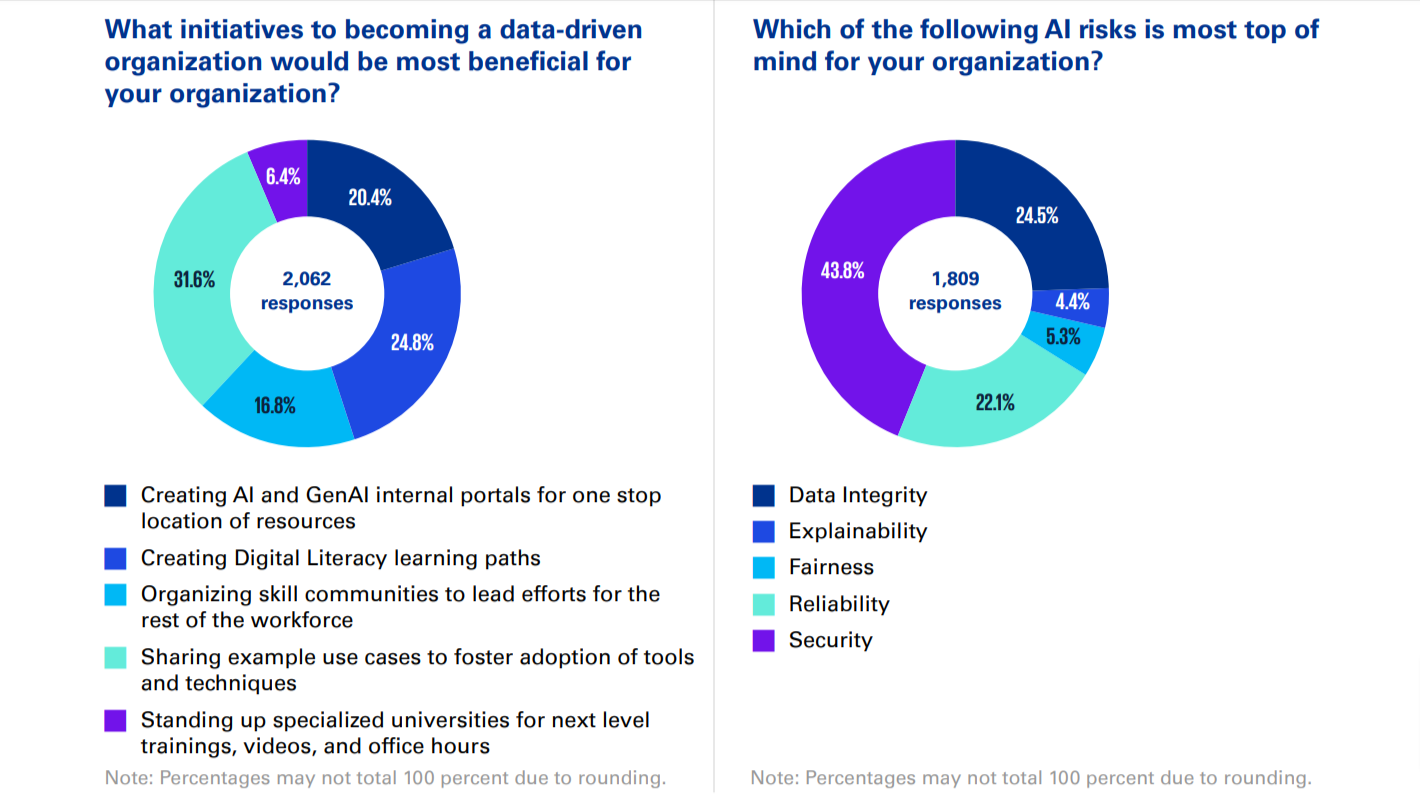

Source: KMPG Report – GenAI for Finance Leaders

As shown from the figures above, the current use cases overwhelmingly play to GenAI’s strengths in language processing, such as Intelligent Document Processing, Invoice Reconciliation, and Benchmarking/Peer Analysis. Survey participants also recognized the need to share example use cases to foster the adoption of tools and techniques, create internal portals for a one-stop location of resources, and create digital literacy learning paths as initiatives that can help the organization become more data-driven.

As expected, data security, reliance, integrity, and fairness ranked high among AI risks identified by participants.

Viable Use Cases in Finance

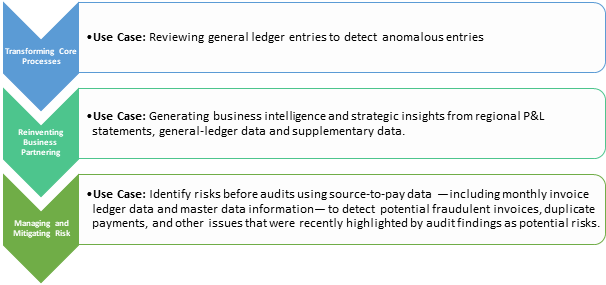

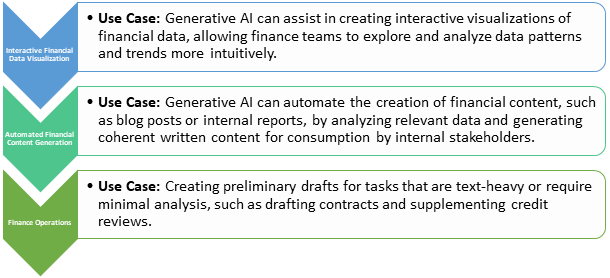

The CFO needs to get started with viable use cases in their functions. So what are they? Here is a small list of use cases, spanning the gamut from Transforming Core Processes, Reinventing Business Partnering, Managing and Mitigating Risk, Interactive Financial Data Visualization, and Automated Content Generation to enabling Finance Operations.

All the viable use cases rely on the traditional strengths of GenAI and LLMs and can thus be used for PoCs by CFOs to move the needle for their organizations.

GenAI is an enabling technology that is changing the way organizations process information. CFOs need to join their other C-suite colleagues in ideating, incubating, implementing, and integrating processes and solutions to support the organization’s overall business goals.

References

About Author

SHARE

Related Blog Posts

Top Technology Trends in Automotive Industry

Technological innovations like AI, autonomous vehicles, and AR are revolutionizing the automotive in...

Telecom Industry Trends: Shaping the Future in 2024

Explore the top 5 telecom trends for 2024: 5G expansion, network virtualization, edge computing, cyb...

6 Benefits of Adopting Low-Code No-Code Platforms for Businesses

Unlock business potential with low-code/no-code platforms: fast development, cost savings, accessibi...

Revolutionizing Industries with Power Platform: Case Studies and Insights

Explore transformative technologies like AI, Quantum Computing, and Industry Cloud Platforms, set to...

Top 6 Emerging Technologies in 2024: A Glimpse into the Future

Explore transformative technologies like AI, Quantum Computing, and Industry Cloud Platforms, set to...

Top Technology Trends of 2023: A Year in Review

Explore 2023's pivotal tech trends: Generative AI's impact, Blockchain's trust-building, Low/No Code...

How Top Industries can benefit most from Data Science & AI

Explore the revolutionary role of Data Science and AI in propelling industries forward. From reimagi...

6 Guided Strategies for Microsoft Power Platform Implementation

The Microsoft Power Platform offers organizations the ability to accelerate digital transformation w...

Choosing the Right Cybersecurity Services Partner: Step-by-Step Guide

In this blog, we'll guide you through the crucial process of selecting the perfect cybersecurity all...

The Value of Regular Security Audits: Safeguarding Your Digital Fortress

Imagine your company's digital infrastructure as a castle and its data as your most treasured posses...

Cybersecurity Awareness Training: Arm Your Team Against Digital Threats

While most organizations invest in state-of-the-art security solutions, there’s often an overlooked...

The Financial Impact of Cyber Breaches on Businesses: Direct & Hidden Expenses

Cyber breaches cost businesses millions, with both immediate and long-term financial impacts. Beyond...

How Technology can help to Bolster Employee Engagement and Happiness

Unlock employee happiness and engagement with technology. Discover strategies like flexible work, co...

Why is Beak the Ultimate AI-Based Solution for Your IT Infrastructure Challenges

Discover Beak - An Intelligent GPS for Infrastructure Monitoring, SOC, NOC & RMM. Streamline ope...

Microsoft Fabric: Unleashing the Power of Next-generation Data Analytics with AI Capabilities

Explore Microsoft Fabric, the cutting-edge data analytics platform that combines AI capabilities wit...

Streamlining Your Migration from Crystal Reports to Power BI

iLink Digital specializes in seamless Crystal Reports to Power BI migration. Explore feature compari...

Streamline Your Business with ServiceNow Bonding: Simplifying Integrations

In today's interconnected business landscape, seamless data exchange between systems is crucial for...

A New Way of Building Attended Automations with UiPath Apps, UiPath Forms & Triggers, and FromIo

Building attended automation is crucial for businesses seeking operational efficiency and improved u...

Conversation AI Vs. Generative AI: Decoding the Difference

In this blog post, we delve into the unique realms of conversational AI and generative AI. We explor...

5 Tips to keep your Salesforce Org Health in Top Shape

As a business leader, it's crucial to prioritize the health of your Salesforce org to ensure optimal...

Ace your Qlik to Power BI Migration in 10 Steps

Are you planning to migrate from Qlik to Power BI? The process can be challenging, requiring careful...

Why Your Business Should Migrate from Cognos to Power BI?

Learn why businesses are choosing to migrate from Cognos to Power BI and how it can maximize the val...

![Aligning DevOps with AWS: Development Stage [Part 4 of 9]](https://www.ilink-digital.com/wp-content/uploads/2023/06/image-400x400.png)

Aligning DevOps with AWS: Development Stage [Part 4 of 9]

Discover the power of DevOps with AWS in the Development stage! Leverage services like AWS Cloud9, C...

Modernization to Elevate IT Resilience: Answering Why & How?

Discover how modernizing your systems can significantly improve your business's IT resilience. In to...

Chatbots for Customer Service: A Must in 2023?

Driven by artificial intelligence, chatbots are shaping the future of customer service with their tr...

5 Strategies for Maximizing Business Value on Your Cloud Journey

In today’s digital era, harnessing the power of the cloud has become an indispensable element for bu...

Maximizing Revenue and Driving Growth with Salesforce Revenue Intelligence

In today's data-driven business landscape, maximizing revenue and driving growth is crucial for comp...

Why Power BI is a Game-Changer for Your Business Intelligence Needs

Power BI is a powerful business intelligence tool that enables organizations to make data-driven dec...

MULTI-TENANCY ON OUTSYSTEMS: Answering How & Why?

OutSystems is a low-code platform that offers multi-tenancy support, a critical feature for modern a...

Greening the Cloud: How Cloud Computing Can Help the Environment?

Cloud migrations have the potential to reduce energy consumption by 65% and carbon emissions by 84%...

Conversational AI in Insurance Industry: Top Use Cases to Explore

Looking to explore the potential of Conversational AI in the insurance industry? Our in-depth blog p...

5 Ways Companies can lower their Carbon Footprint and Contribute to a Greener Future

As we navigate through the climate crisis, the need for businesses to prioritize carbon management h...

Mastering Salesforce Queues: A Comprehensive Guide to Boosting Your Productivity

As a sales professional, you're always looking for ways to streamline your work and be more producti...

6 Technologies to help your Business Achieve Sustainability Goals in 2023

Many corporate leaders are also discovering that sustainability can deepen their organization’s sens...

How IoT is reinventing Manufacturing and Supply Chains Industries in 2023?

IoT has transformed manufacturing operations and supply chain management by increasing operational s...

The Future of IoT: Trends and Predictions for 2023

The Internet of Things (IoT) has come a long way since its inception over a decade ago.

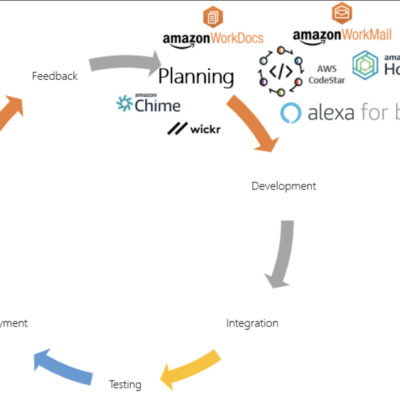

Aligning DevOps with AWS: Planning Stage [Part 3 of 9]

In this article, 3rd in the series, we will discuss the Planning stage of DevOps using AWS and intro...

Cloud-Based RPA: The Next Frontier in Automation

Automation has become a buzzword in the business world, and for a good reason. Companies are embraci...

How can Businesses use ChatGPT to upgrade their Customer Services?

Businesses can leverage ChatGPT to take their clients’ experience to the next level. For example, re...

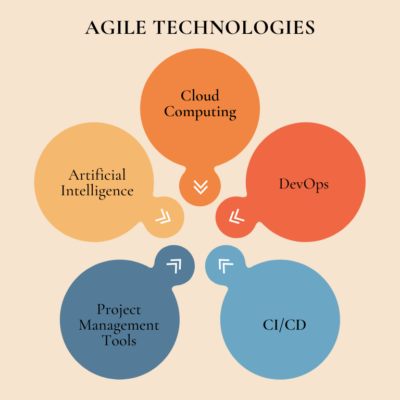

Agile Technologies: Revolutionizing Business Efficiency and Innovation

Businesses that use agile technologies have gained insights, worked faster, and built stronger relat...

Top 7 Salesforce Trends To Follow in 2023

As one of the most powerful CRM platforms, Salesforce assists businesses to build customer databases...

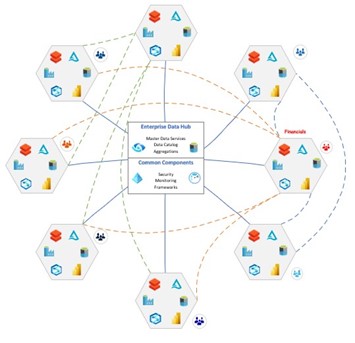

What is Data Mesh? | Architecture, Principles, and Benefits

What is Data Mesh? Data mesh is a decentralized data architecture that groups data according to a pa...

Understanding Data Fabric, its Key Components & Benefits.

Data fabric integrates and connects to your organization’s data while removing the complexities invo...

What is IoT Analytics and Why Business Leaders should care?

48% of companies use IoT in their business. Imagine the amount of customer data being collected. Wit...

Aligning Services with DevOps Stages [DevOps with AWS – Part 2 of 9]

One popular platform for implementing DevOps practices is Amazon Web Services (AWS). In this article...

9 Best Practices for Protecting Data Privacy in 2023 and Why they shouldn’t be disregarded.

The average cost of a data breach is currently $4.35 million, and that amount will only increase. Al...

Breaking Down Data Silos: How Microsoft Fabric and Databricks Create Cost-Efficient Hybrid Solutions

The data disconnect is costing enterprises millions. Here’s how to fix it without breaking the...

Reengineering Quality: Why Your Quality Assurance Process Needs a Strategic Assessment

In an age where software drives every touchpoint—whether it’s a mission-critical enterprise tool or...

Redefining Campaign Success: How AI is Revolutionizing Salesforce Marketing

Marketing teams today aren’t short on data. The problem? Most of it isn’t telling a story—just numbe...